I hate insurance shopping. Medical insurance, travel insurance, car insurance – I hate it all. I’ve always referred to travel insurance shopping as the worst thing to do on my trip-planning list. Nothing squashes the excitement of a trip more than reading the fine print of all the ways you can die or things can go wrong on a trip. It’s enough to make you cancel your ticket right then and not get on the plane.

I still remember back in 2006 reading through insurance policies before my big career break trip. I was already pretty intimidated to do such a big trip around the globe for a year, and learning about all the stuff that could go wrong was a sobering experience. I nearly chickened out that day. Boy, my life would have been different if I had chickened out and never traveled.

Insurance is all about statistics, I’ve always wondered when my luck would run out; the longer one travels the greater the chance you’ll need it. And I’ve been traveling for 12 years now practically non-stop. I’ve been through every type of travel insurance and medical insurance purchasing you can imagine in the last decade of my travels and life on the road.

Table of Contents

Danger is everywhere!

My Travel Insurance History

In the last decade, it seems that travel insurance has hit a boom. Now you can’t even purchase an airline ticket without being reminded to buy insurance. It’s a big switch from when I started traveling and sorting through all of the ups and downs of insurance coverage.

Check out all the best gifts for friends going traveling

Career Break/Long-Term Travel Coverage

When I initially left for my year-long career break in 2006 I was doing long term travel which meant I was less concerned about trip delays or cancellations (my schedule was really flexible), and mainly I was concerned about medical coverage as I traveled to 23 countries. I ended up getting a year-long international medical insurance plan that covered me.

Expat Coverage

Then I became an expat and lived in Vietnam for a year where I purchased expat insurance specific to Vietnam medical coverage. I would supplement that with a little travel insurance policy if I was traveling outside of Vietnam for a break.

For the next 5 years, I continued to travel on a different expat international insurance that covered me all around the world for medical coverage, including the US. Once again – my schedule was flexible so I didn’t worry about the trip cancelation or typical travel coverage. It worked great until Obama Care came along and my current plan didn’t qualify under the new rules since it took into account pre-existing conditions. Sadly, I needed to make a change again.

Multiple Single Trip Coverage

My travels had by then evolved into me coming in and out of the US more and doing shorter trips oriented around my blogging or freelance work. So it was time to get US insurance again for medical coverage – but there was a problem…I didn’t really have a home in the US. I used my parent’s address as my home for taxes and insurance and that worked ok for a couple of years.

However, the typical medical insurance (at least for a self-employed person buying through the government marketplace) doesn’t cover you outside of your state or country, so I started purchasing travel insurance for every international trip.

And that puts me at the present day. Trying to remember to purchase insurance every time I travel, and having to go through all of the ways that things can go wrong again, and again, and again. Ugh.

Annual Travel Insurance Plans

But I found a way to ease the pain of purchasing insurance – I bought an annual multi-trip travel insurance plan that I only had to renew yearly!

If you want to know why you should have travel insurance (Ahem…COVID!), there are a billion articles out there and why to get travel insurance. The Allianz annual plans do include their epidemic coverage endorsements so you will be covered for various epidemic scenarios too. But once you have decided you need it, here are the tips to use to determine how to decide what to purchase.

Read about 3 ways to minimize travel disasters

Tips for Buying Travel Insurance: Single Trip or Annual

It’s not a process to be taken lightly. The one thing that remains constant for any kind of travel insurance purchase is that you need to do your research. Sure, it’s easy to simply tick a box and pay an extra $20 and purchase insurance, but do you really know what you are buying?

These tips for buying travel insurance will help ensure that you have exactly what you need for the type of trip you are doing.

1. Do All of Your Research and Purchase in a Single Day

If you are doing multiple trips, take one day set it aside, and do your insurance shopping for the year. There really is very little good news when it comes to insurance; you are betting on something going wrong – and that’s never fun. Treat your research and purchase day like pulling off a piece of tape on your hairy arm – know that it’s going to hurt, and just get it done all at once. Once you have determined what will work – just purchase it, have a stiff drink, and forget about it. Go back to the fun trip-planning stuff the next day.

2. Read the Fine Print

Sure – maybe some people don’t read the fine print of insurance policies – but I do. Probably because my father taught me to trust no one – especially insurance companies. Go through all of the details, expand all of the boxes, write down words you don’t understand, and write down questions as they come up.

3. Call Your Current Insurance Carriers and Ask Specific Questions

Make sure you know how your home medical insurance works overseas or traveling out of state. Will they cover emergencies? Will they fly you out of Antarctica if there is an emergency? Call your homeowners or renters insurance company and find out what they will cover if you are traveling and your laptop is stolen out of your rental car. Call your car Insurance and find out what they cover if you get in an accident in your rental car in France. You have to first understand your current insurance to understand what you exactly need out of travel insurance.

4. Call the Prospective Agency and Ask Specific Questions About Scenarios

Call the company you are considering buying travel insurance from and ask them detailed questions about scenarios. “If I get in a car accident in Nepal and break a wrist, will I be covered?” “Is hiking Kilimanjaro covered?” “What if I had knee surgery 2 months ago, and I hurt it again while hiking on my trip – is that considered a pre-existing condition?” What if my luggage is lost or delayed and I have a very important meeting or presentation that day and I have to give but I have nothing business-appropriate to wear? The list can go on and on. Ask lots and lots of questions. A good customer service agent should be able to answer them. If they can’t or give you vague answers about ‘it depends’ then this likely isn’t the company for you.

5. Talk to People Who Have Filed a Claim Before

Go out on forums and see if you can find people who have actually filed a claim with the company you are considering. Ask them about the process and how it went. Would they recommend the company to you?

6. Know What Adventure Activities Are Covered on your Travel Insurance Plan

What is exactly considered an adventure activity? This has always been a mystery to me and it requires you to read the fine print and in some instances call for clarification. Is all biking covered? Or when is biking considered mountain biking? And because I love to hike around the world (LINK) my favorite question is always, what exactly is high altitude hiking – is there a specific altitude that is considered ‘high altitude activities’ and not covered? (NOTE: most travel insurance companies won’t cover high-altitude hiking). I just read my most recent policy and found some of these things that weren’t covered:

- flying or learning to fly an aircraft as a pilot or crew member

- participating in or training for any professional or amateur sporting competition

- participating in extreme, high-risk sports like:

- skydiving, hang gliding, or parachuting

- bungee jumping

- caving

- extreme skiing, heli-skiing, or skiing outside marked trails

- body contact sports (meaning any sport where the objective is to physically render an opponent unable to continue with the competition such as boxing and full-contact karate)

- mountain climbing or any other high-altitude activities

- scuba diving below 120 feet (40 meters) or without a dive master

7. Understand the Coverage Limits and the Minor Details

Great that a policy says it covers stolen luggage, but what does that really mean – you have to dig into the fine print. What if your bag with your laptop or camera in it is stolen at the railway station in Austria? Is it covered by the annual travel insurance policy? Most policies have amounts they cover – will $300 cover your laptop? Some policies require you to have the original receipt to prove you owned the property.

I’m pretty sure my laptop and camera receipts are long gone since I bought them 4 years ago. These are just some things to consider when looking at the fine print.

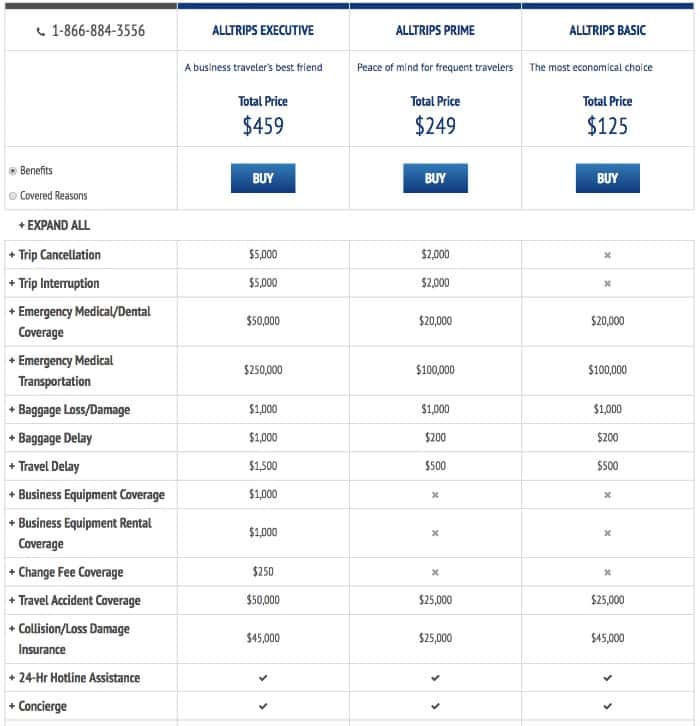

I looked up my most recent annual multi-trip travel insurance policy coverage and found this:

Maximum $500 in total for all jewelry, watches, gems, furs, cameras and camera equipment, camcorders, sporting equipment, computers, radios, and other electronic items. You need to provide original receipts for these items or they won’t be covered.

8. Understand Primary and Secondary Coverage.

Most travel insurance perks are secondary coverage. It’s great that they have medical and car insurance coverage – but understand that if it’s secondary coverage you’ll have to go through your primary coverage first.

Buying travel insurance is a lot of work if you want to be informed and really understand what you are getting. However, with an annual multi-trip travel insurance plan – you only have to go through this process once a year! Hallelujah!

Allianz Annual Travel Insurance Plans

I recently purchased an Allianz Annual Multi Trip Travel Insurance Plan. I decided upon it for a few reasons; I travel a lot and normally take 8+ trips a year and with an annual plan I would only have to go through this research process I hate once a year instead of every trip!

Who is an annual travel insurance plan for?

If you are a frequent traveler taking 3 or more trips a year – you’ll want to look into the Annual plans. OR – if you take a bunch of micro-cations/shorter domestic trips (think road trips, a weekend in a city that had a great airfare sale, a national park trip, or maybe even the new Rocky Mountaineer train trip through Colorado), you’ll want to consider an annual plan.

All of your trips are under 45 days in length. There is a stipulation on the annual policy that it only covers annual trips that are 45 or less days. (see…you have to read the fine print!!)

Your current medical insurance doesn’t cover you overseas in emergencies or emergency evacuations.

You are an entrepreneur or freelancer who travels for business a lot. If you are freelancing or consulting, that normally means you are responsible for all of your own insurance – even on business travel. Allianz has a special business traveler annual plan worth looking at further.

Learn more about the Allianz annual travel insurance plans here :

I have been buying Allianz travel insurance now for the past 2 years, but every time I still read through the fine print details and call and ask questions. I’ve never had to make a claim, but their customer service agents have been very helpful in answering my questions. In addition, they have a great Travel Smartphone app that I use all the time when traveling for medical questions and needs!

Now that you have followed my tips for purchasing travel insurance, purchased your annual plan, and downloaded the TravelSmart app…it’s time for the ever-important next step…go have a drink and forget about all of this doom and gloom. Go back to thinking about climbing mountains in far-off lands, sipping slushy drinks on the beach, or eating pho on the streets of Vietnam!

Disclosure:

This post is sponsored by Allianz Global Assistance (AGA Service Company) and I have received financial compensation.

By Sharon June 4, 2018 - 2:30 pm

Thank you for this informative article. Like you, my husband and I have traveled up to 4 times a year, and only until recently have I come to even know about this annual choice. I appreciate the tips and your thinking on these matters.

By MsNomadica July 14, 2018 - 3:17 pm

Are you back in the States every 45 days? That’s only about 6 weeks, and I was under the impression that you were usually gone a lot longer than that. I feel like, to average out my monthly travel expenses, I need to stay at least 2 or 3 months to make a transatlantic ticket worthwhile. I buy from World Nomads, since they let me renew my policies while I’m still outside of the US. I had read that a lot of companies will only sell you the insurance before you leave your home country, which I found a little weird. I don’t know if that’s still true. World Nomads also base their prices on your age and the countries you visit, and the more months you buy at a time, the lower the per monthly price. I don’t know if they offer an annual price, but I rarely know where I’ll be for an entire 12 months in the future at any given time. So I just buy my policies after I have all my reservations booked, so I know for sure where I have to book insurance for. It’s usually for 3 months at a time, but it comes out to over $100 a month, so I’m still looking around

By Sherry July 16, 2018 - 12:04 pm

Yes – I used to use World Nomads as well as some other expat oriented insurance when I was traveling for longer periods. However, these days I have a home base in the US again so most of my trips are 2 to 4 weeks – so I fit nicely for the Annual insurance plans from Allianz. AND I too never know where I’m going next so I like the fact that I just buy it once and I don’t have to update where I’m going or anything…plus it covers me for travels in the US when I’m away from my home – so that’s cool. It all just depends on your specific situation! And it’s hard to find one that meets a true nomadic lifestyle still!

By Divya Reddy Margam September 14, 2018 - 3:54 am

I appreciate that you shared such a great thing. Previously, I didn’t know about the yearly plans but the company from where I always use to renew my policy, they informed me about it after knowing that I have to travel around 8-9 months. they always send me the reminder for renewal of policy. Will it be fine to get the yearly package just for US travel as I just have to visit US for my work.

By Sherry September 14, 2018 - 2:44 pm

You will need to check with Allianz directly. I’m not sure about the US coverage plus – I do know that your trip can’t be longer thatn 45 days I believe. I would look into both of those things before purchasing.

By S. Carvalho December 20, 2018 - 3:34 am

Thanks so much for the info about the 45 days. I was literally just about to purchase allianz’s multi-trip policy when i saw your post and realized it can’t work for us. Btw, a recent download of the prime policy said a trip is defined as 90 days, so your readers might want to call and check if they are within the 45-90 day window.

By Sherry December 27, 2018 - 11:50 am

Thanks for the update!